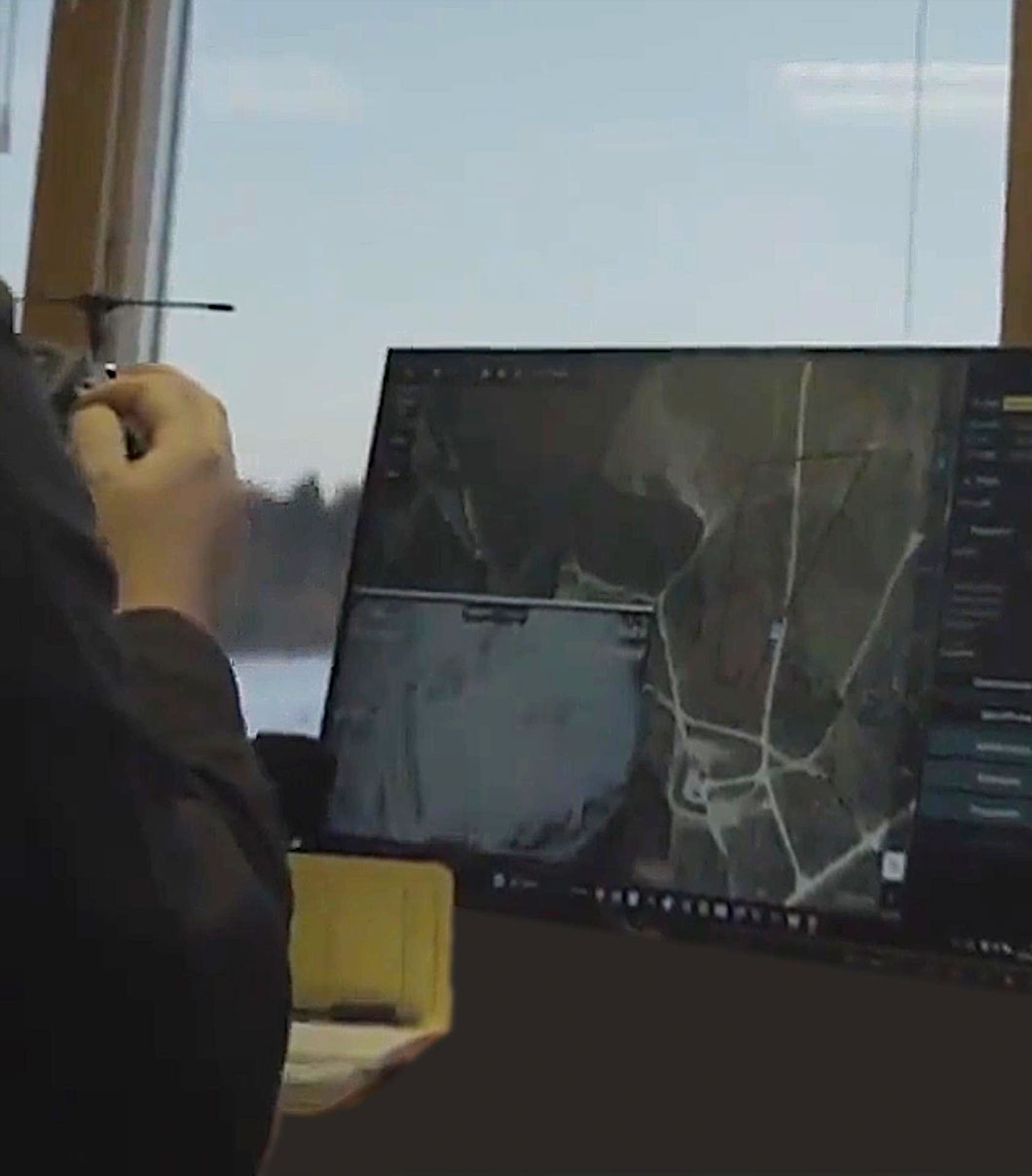

At Cyberlux, our mission is to provide cutting-edge aerial support and communication solutions, driven by innovation, resilience, and unwavering dedication to empowering our customers. Our Unmanned Aircraft Systems are designed for warfighters, law enforcement, and other government agencies. Our tactical military communications equipment is recognized globally for performance, ease of operation, serviceability and low life-cycle cost. Partner with Cyberlux for a successful mission.

Solutions for your mission

ABOUT US

Cyberlux Corporation

Established as an Advanced Lighting Company, Cyberlux Corporation has grown into a supplier of military equipment and systems for both the United States Department of Defense as well as international military allies. Customers include the United States Air Force (USAF), US ARMY and the Intelligence Community. Cyberlux continues to serve it’s DoD and International Partner Nation customers along three distinct business entities.

- Unmanned Aircraft Systems (UAS)

- Datron Military Communications (DMC)

- Global Integration Services